If you’re an Other Expat like us, you have likely hit the wall of confusion that is filing your income tax. While there are some of us fortunate enough to have efficient HR departments that take care of everything, many of us still have to rough it out and do it ourselves.

We know the challenges you can face as an expatriate when it is time to file your income tax. There is little easy-to-comprehend information online in English about how, where, and when to file your income taxes, most of the government employees give us very general information about how to do it.

“Just go to the Hasil office, then do it online, it’s so easy!” is what you’ll hear often. And when you do show up at any one of the Hasil offices, the queues are long, the instructions are confusing, and the notices posted on the walls are mostly in Bahasa Melayu. To make the process a tiny bit easier, we have prepared a primer/simplified step-by-step guide based on our own experiences to help you understand what you need to do and how to do it.

Please note that this guide is specifically for foreign employees of companies (employers) in Malaysia who earn a monthly income from their employers, and those who fall under the category Residents (read on for more information on this). For other types of taxable income received by foreigners in Malaysia, please check the section on other taxable incomes at the end of this post.

The basics

Let’s begin with the basics, especially if this is your first time to file your income tax (ever, or in Malaysia).

What is taxable income, and who needs to file them?

If you are employed by a company in Malaysia, and you earn a monthly income of more than RM 2,500, that income is taxable. This means that you have to pay a percentage of that income to the Malaysian government. Specifically to the Lembaga Hasil Dalam Negara Malaysia (LHDN), or Hasil for short. This is the Malaysian Tax Return Agency, or the Inland Revenue Board of Malaysia or IRBM.

How much of my income do I need to pay?

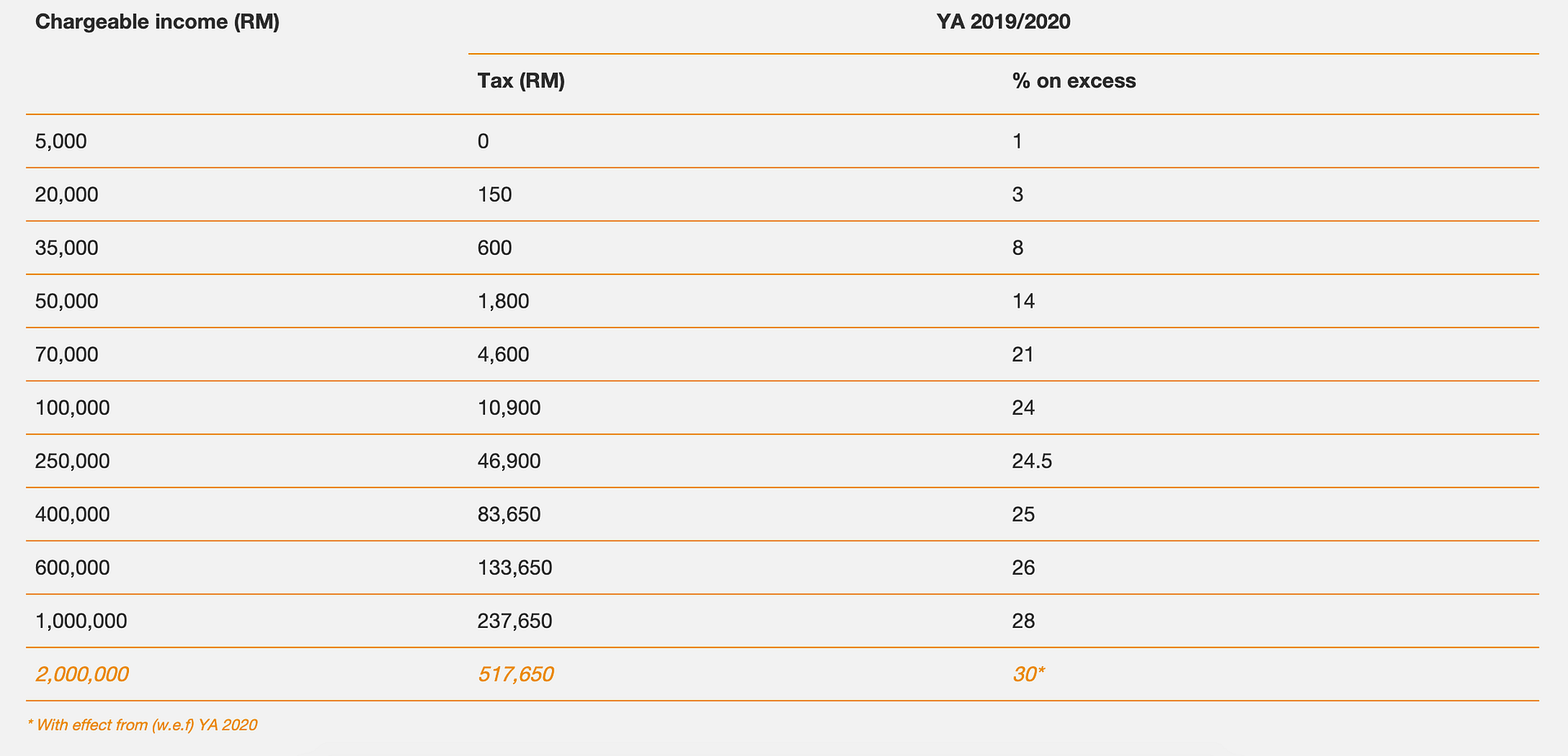

Income taxes are rated differently, depending on the length of your stay in Malaysia and your income.

Non-residents are foreigners who spend less than 182 consecutive days in the country. The tax rate for this group is a flat rate of 28% of their basic salary.

Residents are those who spend more than 182 consecutive days (or around 6 months) in the country. They get taxed between 0% and 28% depending on their income, with higher salaries getting higher taxes. Please note that this guide is prepared specifically for this group.

If you have to travel or be outside of Malaysia for less than 14 days (or for medical or work reasons for more than 14 days), those days are still counted when determining whether you have spent those 182 days in the country.

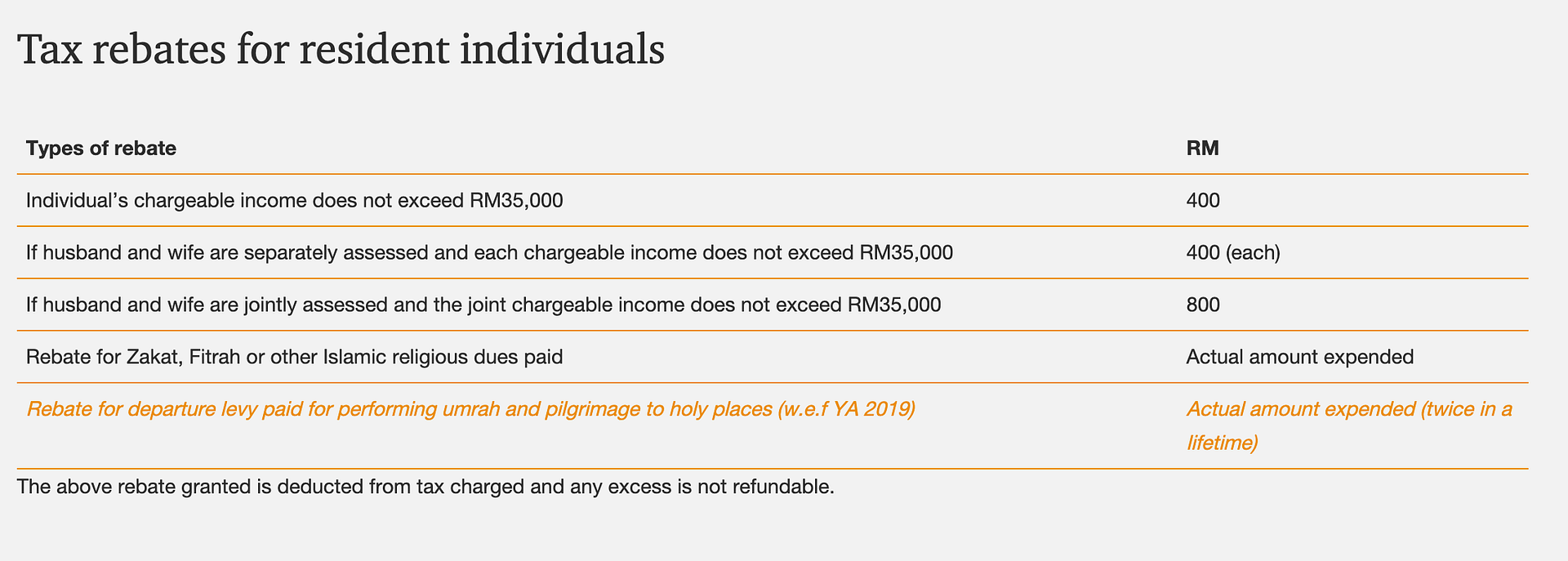

Residents, unlike non-residents, are eligible for some tax reliefs and tax exemptions (more on this later).

Here’s a table of tax rates for different incomes (and you can also check with your HR or with Hasil exactly how much of your salary will be deducted every month):

How is my income tax paid?

Most companies subscribe to the pay-as-you-earn scheme, where an amount is deducted (using the tax rates above) monthly from your income by your employer, and then remitted to LHDN that same month.

Make sure that you keep copies of your payslip where this deduction is indicated, in case you’ll need some proof later on. You should also discuss with your employer/HR the tax rate you fall under so that there are no unpleasant surprises come payday.

Why do I need to file my income tax?

After paying your income taxes monthly for a full year (starting on the first day of January and ending on the last day of December of the same year), you will need to prepare to file your taxes — basically to report to the LHDN that you have paid your taxes for that year, and to submit receipts that you can claim for tax relief or tax exemption if applicable.

The LHDN assesses your submission and checks to see if you need to be refunded (in cases that you may have overpaid due to a miscalculation, for instance). Or if you need to pay more (if you are underpaid because of a miscalculation). The LHDN will then do the calculations and, if you have any tax relief or tax exemptions, factor those in, and then inform you of what you can claim from them, or need to pay.

What are tax reliefs and tax exemptions?

These are benefits from your company (e.g. housing and transportation allowances) and some of your expenses (e.g. gym memberships, sports equipment, and education) that can reduce your taxable income.

Discuss this with your employer/HR, as they can explain and identify which of your benefits are eligible for tax exemption.

You can also check PricewaterhouseCooper’s booklet on taxes in Malaysia for a comprehensive list of which benefits and expenses are eligible for tax relief and tax exemptions.

Remember to always keep the original receipts for your purchases that are eligible for tax exemptions, so that you can claim them later.

The EA form

This information—your income, bonuses, and benefits (in monetary value)—should be listed out clearly in your EA form, a document your company should give to you by the end of February every year.

Your EA form might be in Bahasa Melayu, but it is also available in English, which you can request from your employer/HR. You will need this document when you file your taxes.

When do I file my income tax?

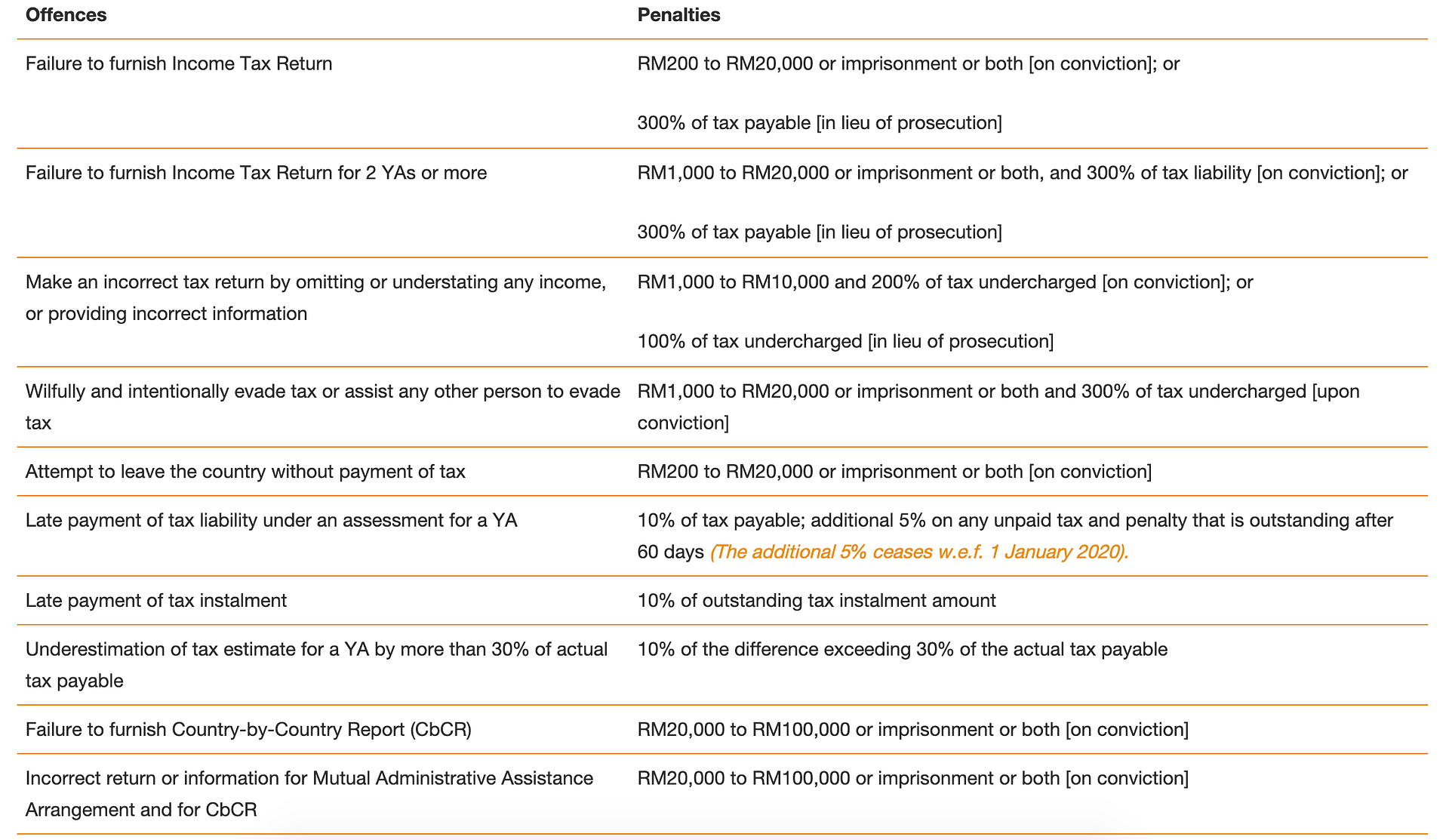

Taxpayers are required to submit/file their income tax returns of a given year before 30 April of the following year. For example, for the year 2018, filing starts on 1 March 2019 and ends on 30 April 2019. For 2020, the deadline has been moved to 30 June because of COVID-19 and the Movement Restriction Order. Missing this deadline can mean a penalty starting at 10% and up to 300% of the tax payable (upon failure of submitting the income tax return form).

Four easy steps to filing your taxes

Now that you have a general understanding of how your income tax in Malaysia works, you’re ready to file your taxes. We outline here a simplified step-by-step guide for you to do this, to save you some time, effort, and headache.

Here’s what you’ll need if this is the first time you’re doing this:

- Your EA form from your employer (check that it has information about the company you work for, such as the company’s ID number and contact details as you’ll be needing this)

- Original passport (make sure that this is valid for at least another 6 months) and at least 2 photocopies of it

- Payslips or any supporting document that indicates your monthly income and that you have paid your taxes

- A supporting document that states you are an official employee of the company you work for

- Two trips to an LHDN office, so probably a (half) day or two off from work

- Lots of patience and courage

- And later, a working computer with internet access (as you can do your filing online)

Step 1

Register as a taxpayer

You need to go to an LHDN office to do this.

We have gone to two branches of LHDN: the one in PJ Trade Centre in Damansara Perdana, and the one in Menara Olympia in Kuala Lumpur. But here’s a list of other branches, so you can find the one nearest to you.

To register as a taxpayer, ask for the form to register, fill out this form with your employment details, and submit it along with a copy of your passport and your certificate of employment.

They will process this. And in 3–5 working days, you will receive a document (most likely in Bahasa Melayu) confirming that you are registered, and providing you with your Income Tax Number. You will need this number later when you file your income tax, so keep it handy.

There might be a delay in receiving this document, however. So while you are still at the LHDN office, it’s probably good to ask for a phone number or email you can contact to follow up on the process in case you don’t receive it within five working days.

Step 2

Get an LHDN e-Filing PIN

After you have registered as a taxpayer, you can now get a PIN to file your taxes online. You will also need to go to an LHDN office to do this.

You’ll be asked to present your passport, EA Form with employer details, your Income Tax Number (from Step 1 above), and your payslips, after which you’ll get your printed LHDN e-Filing PIN (16 numbers in four sets of four). This will be given to you immediately.

Step 3

Sign up for an online Hasil account

You are now ready to file your income tax online, avoiding the long queues at the LHDN offices. Signing up for an account is the first thing you need to do.

1- Go to http://ez.hasil.gov.my

2- Disable any pop-up blockers for this site

3- You can change the language to English (on the top of the page) before you proceed

4- Select First Time Login and enter your e-Filing PIN (from Step 2 above)

5- You’ll be directed to a form that will allow you to input your preferred password for future logins

Once you have signed up, you will be directed to the login page again, where you can now log in with your passport number, and your new password.

Step 4

File that income tax!

And now, finally, here we are.

1- Log in to your Hasil account (from STEP 3 above)

2- Under the Services tab, go to e-Filing

3- Under the e-Filing section, click on e-Form

4- Inside the e-Form section, select the Year of Assessment for e-BE (Resident individual without a business source of income)

5- You will be directed to a form you’ll need to fill out with information from your EA Form. There are 3 sections for you to fill out, so make sure you do them all – personal details, income details, and tax deductions.

6- At the bottom of the form is the Summary tab, which summarizes all the information about your income tax for that year. The last line will tell you if you have a balance that you need to pay, or if there is an amount that will be refunded to you. Click Continue to submit this form.

7- You will be directed to a page where you can make payments (if you need to), and where you can upload copies of receipts (also where necessary).

8- LHDN will now assess your submission, and you will receive details of their assessment within 5 working days.

Aaand you’re done. Rinse and repeat next year.

Additional tips

- Always make sure you have documents as proof that you have paid for and filed your taxes. If you don’t receive the documents, contact LHDN and make a report as soon as you can.

- When you go into an LHDN office, you’ll most likely see a long queue—don’t just simply join them and cue up, too. It’s generally ok to go up to a counter (and jump the cue) or ask an employee or security guard about where to cue up or take a number for what you need to do (e.g. register as a taxpayer or get an e-filing PIN or ask for assistance/help in filing your income tax). This will save you some time, as there are different lines and counters for different purposes, and most of the offices are not explicit about what they are. Just don’t be rude about it, and people are generally open to helping you.

- When you renew your passport, don’t forget to also update the LHDN office with your new passport number. You will have to visit an LHDN office to do this, so bring your original old and new passports, and at least 2 copies of the new one.

- If in doubt, ask (an LHDN employee). And when you do ask, be very specific—and very patient! There might be some problems with your communication with them in terms of language barriers, but do insist on getting correct information to avoid any future problems.

- You can make payments offline, too, if you prefer. LHDN provides a number of agents and financial service providers where you can do this.

- You also have the option to get help from a licensed tax agent to file your income tax, for a fee. Ask at the LHDN office for a list of agents, or your HR department or employer, but only go with one that you can trust, though. Beware of scammers!

Other taxable incomes

Here’s a quick guide on the other kinds of taxpayers, and which forms they need to fill out.

B Form: For individuals whose income includes a business source (Deadline: 30th June)

M Form: For Non-residents whose income is without a business source, or with a business source (Deadline: 30th April)

P Form: For partnerships (Deadline: 30th June)

You can get more information on these from the Hasil website, or from the PricewaterhouseCoopers booklet.

That’s the gist of it. We hope this simplified guide was helpful to you! Let us know about your experience, or if there’s anything we missed.

Share this post and sign up with us to get more helpful tips like this. You can also contact us if you’d like to contribute, or just have a chat!

Hi, what happens if I wasn’t in the country for more than 14 days in the first 182 days of the following year? Do I become ineligible to get the refund altogether or is there any other considerations?

Thank You,

Sreehari

i have worked in Malaysia penang from feb2017 to sep2017 the company deducted28% tax upto 6 months. i left Malaysia and back to india after 7months. nearly 9000rm is holding in Malaysia tax. can i get back this money do you have any solution for this.

We’ll check and get back to you on this